consultant & project manager

CLIENT’S MAIN REQUEST

Implementing a tech solution that allows:

- online registration of guarantee requests by the financing institutions /banks;

- a faster and simplified exchange of documents between the parties involved in the processes;

- optimized workflows.

SOLUTION

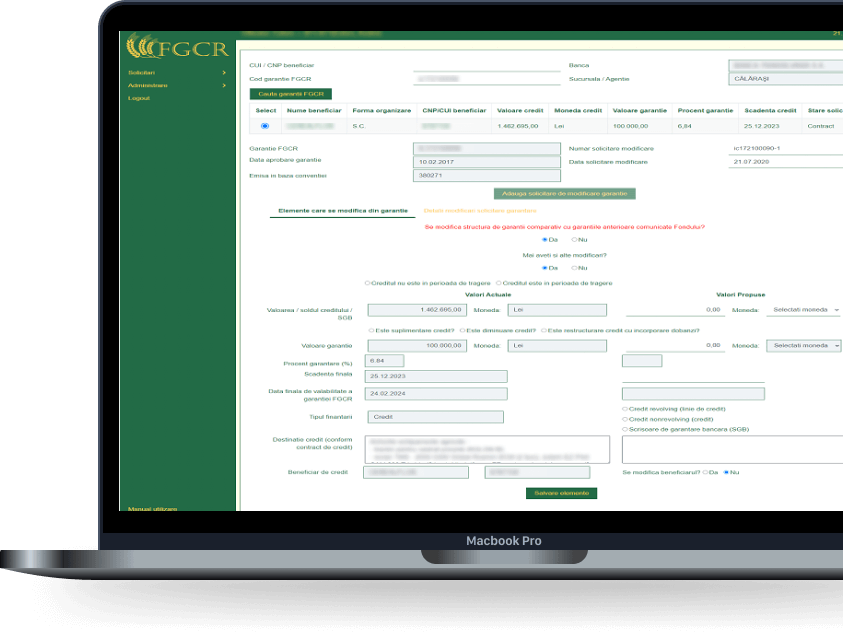

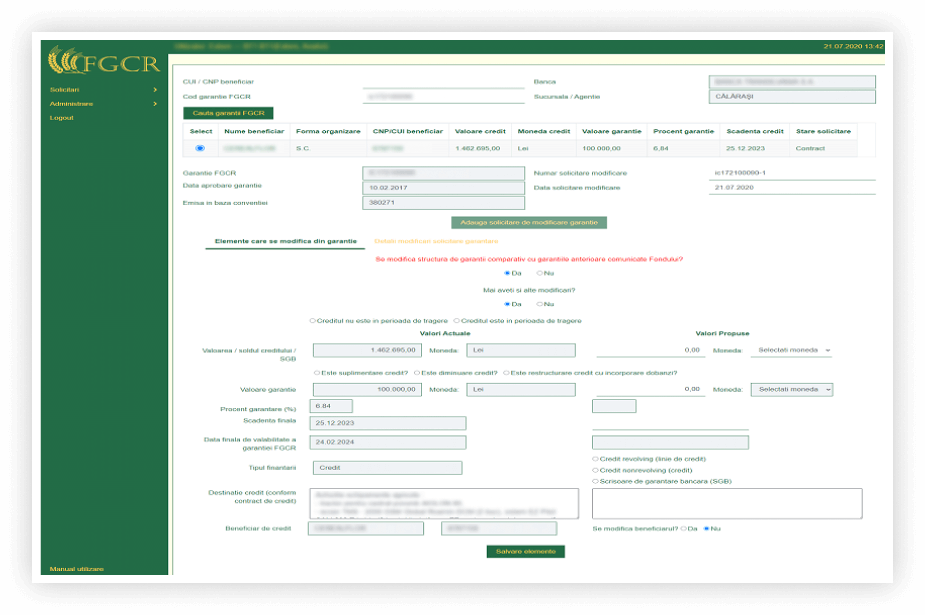

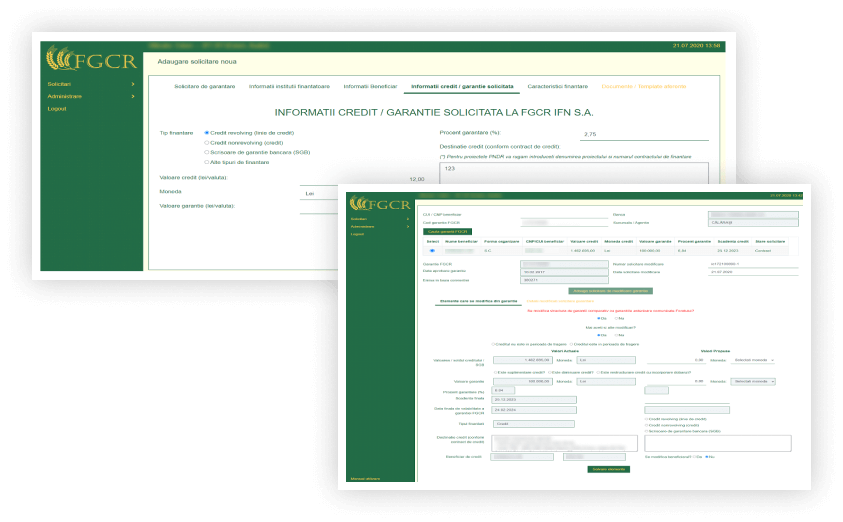

The platform allows users to:

- enter the information related to the guarantee requests;

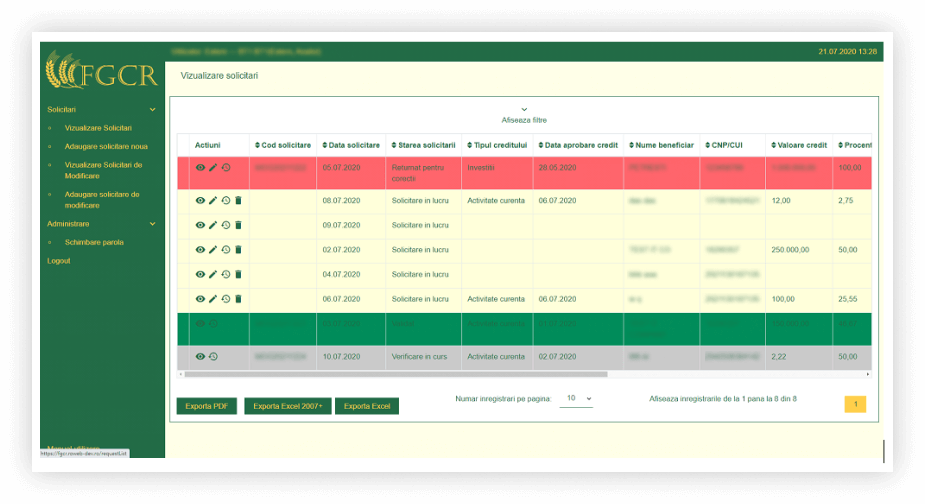

- view warranty claims;

- modify the information/data entered;

- load / delete the documents related to a guarantee request.

Project highlights

- FGCR constantly receives from the financing institutions a large volume of requests for obtaining guarantees.

- Initially, the process of collecting /storing/synchronizing the transmitted data and documents was quite slow and time-consuming.

- We’ve created a Web application for FGCR (developed in .NET C # with MVC pattern). This app allows users from the financial institutions to:

- enter the information related to the guarantee requests;

- view the warranty requests, to modify the information/data entered;

- load / delete the documents related to a guarantee request.

- The developed platform has fully responded to the client's needs and, currently, helps FGCR to increase his productivity and performance at

the level of processes carried out with third parties; - The benefits brought by the digital solution we’ve delivered determined the client to want further developments and optimizations.

Therefore, FGCR decided to extend the collaboration with Roweb by starting a second phase for this project.

Roles we cover

HTML developer

developers

(ASP Net Web Forms Developers)

Technologies

ASP.NET WebForms, .NET Framework 4.6, Google reCAPTCHA, Microsoft ASP.Net Identity, BCrypt.Net-Next, Serilog, nClam, Dapper ORM, Twitter Bootstrap, Toastr.js

Services

Consulting, development & implementation of business applications

Status

Phase 1 of the project is completed - the client requested the extension of the collaboration with phase 2 in order to develop and implement additional functionalities

Location

Romania

Industry

Business app for financial services

Contacted Roweb

from the website

Our client

Our client, the Rural Credit Guarantee Fund (FGCR), has the mission of giving support to SMEs, in order to obtain financing (from banks or other financial institutions) by guaranteeing their loans.

More precisely, the role of FGCR is to assume guarantee commitments and issue guarantees for supporting agricultural and fisheries production by farmers and processors of agricultural products, investments in agriculture, aquaculture and the implementation of co-financed projects.

THE CONTEXT

FGCR constantly receives from the financing institutions a large volume of requests for obtaining guarantees.

Initially, the process of collecting / storing / synchronizing the transmitted data and documents was difficult and time-consuming.

Updates and data processing were mostly done manually, while documents were transmitted using traditional digital tools (for example, e-mail) - which led to delays and difficult trackings along the process.

Client’s goals

The client was looking for a technical solution that can be synchronized with the existing app, simplifying and shortening both internal and external workflows. The solution should also be easy to use and help users quickly access, view, and process the information they needed.

THE SOLUTION

Consulting

The client had a well-defined business need (optimization of data collection, validation, and processing flows) and was looking for a digital solution to solve every key-point in the process.

To define their specific needs and establish how this technical solution should solve them, FGCR also requested our consulting service.

Roweb proposal

Considering that the new platform aimed to simplify and optimize workflows for several users (both from FGCR and financial institutions), we simultaneously followed two directions for designing the solution:

- developing a solid technical solution that allows data synchronization and automatic updates;

- ensuring an intuitive interface with which users can adapt quickly and allows them flexibility in editing, updating, etc.

Together (the client & Roweb’s dedicated team), we analyzed the data flow and identified its specific needs regarding data collection, storage, and synchronization through an online module connected to the existing application.

Even if the performance was the core factor of the delivered application, we wanted the solution to be also intuitive for users. Thus, we have taken into account a UX adapted to the users' needs. That way, the data that reaches the system can be collected and validated much easier.

The Solution

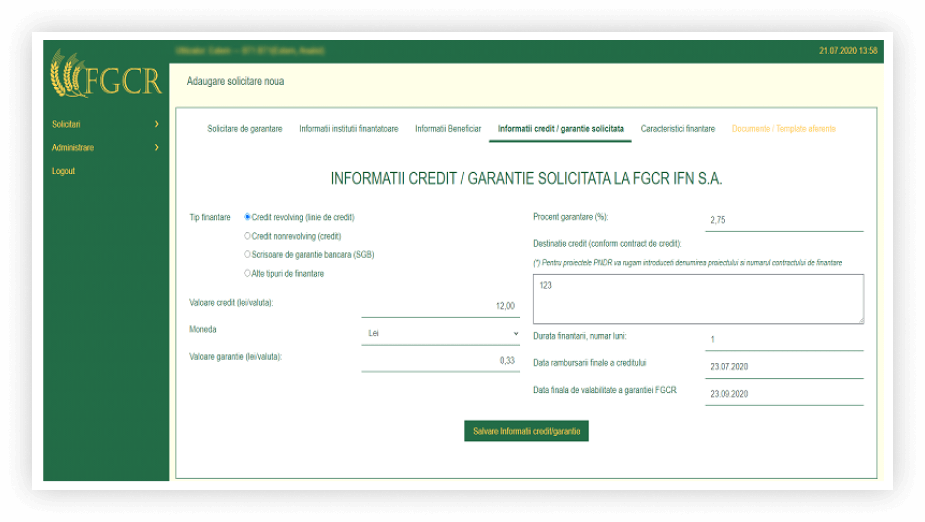

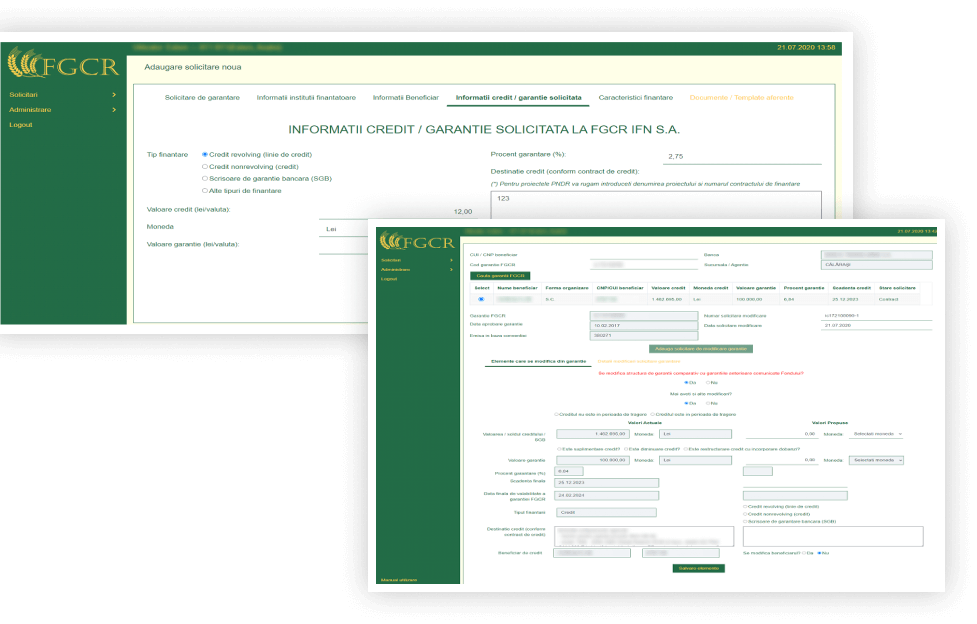

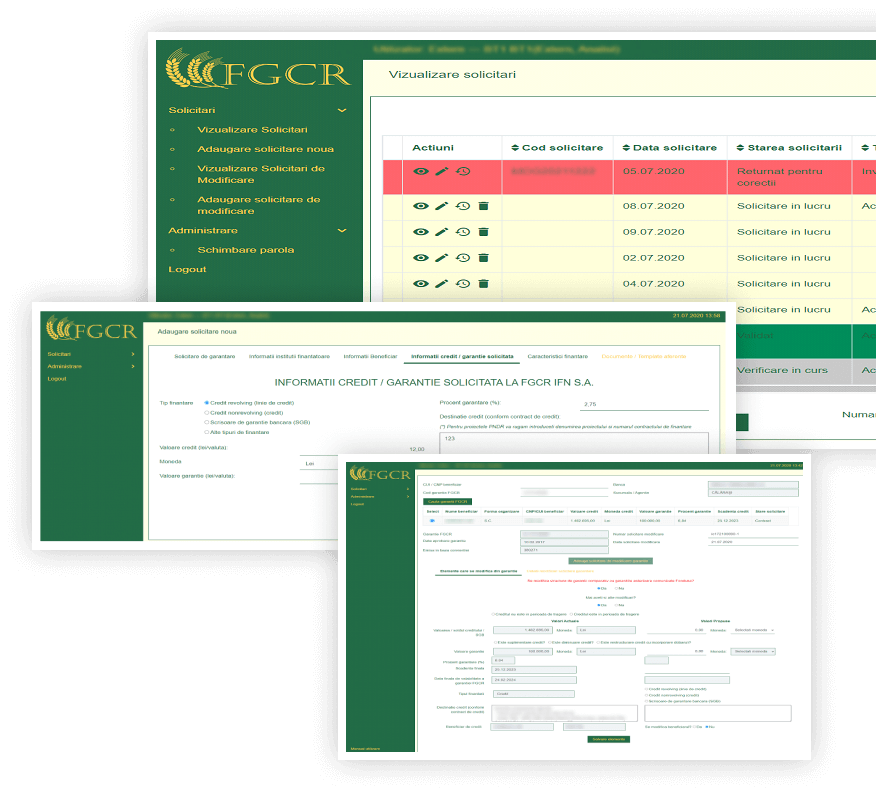

We have created for FGCR a Web app that allows users from the financial institutions to

- enter the information related to the guarantee requests;

- enter the information related to the guarantee requests;

- modify the information/data entered;

- upload/delete the documents related to a guarantee request.

The Online Module application was developed in .NET C # with MVC pattern and was structured on 3 levels:

- Data access layer (DAL) for database access operations in MS-SQL;

- In the BUSINESS Logic Layer (BLL) layer is the implementation of the DAL module over which the logic of storage, modification, validation and aggregation of financial data is applied;

- The web module accesses all the data provided by BLL and allows interaction with users.

Technologies, frameworks and libraries used:

- ASP.NET WebForms with .NET Framework 4.6;

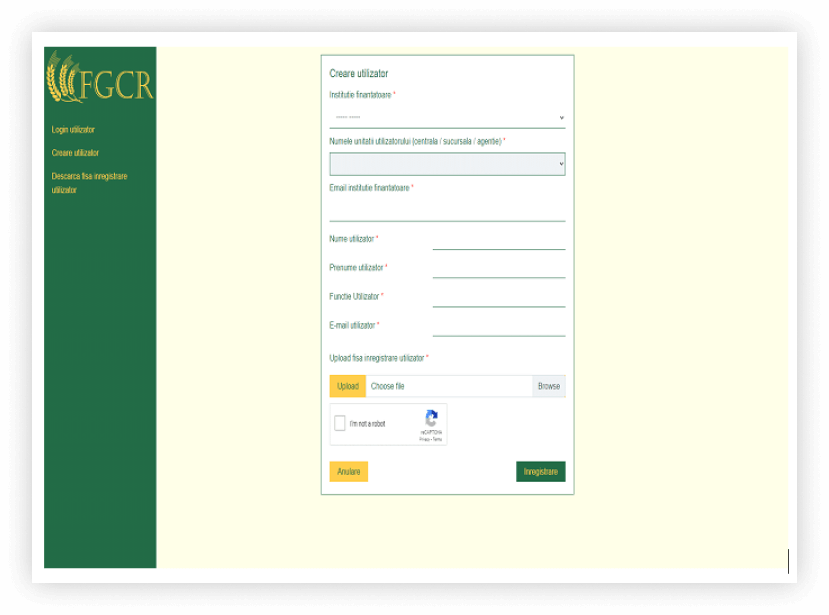

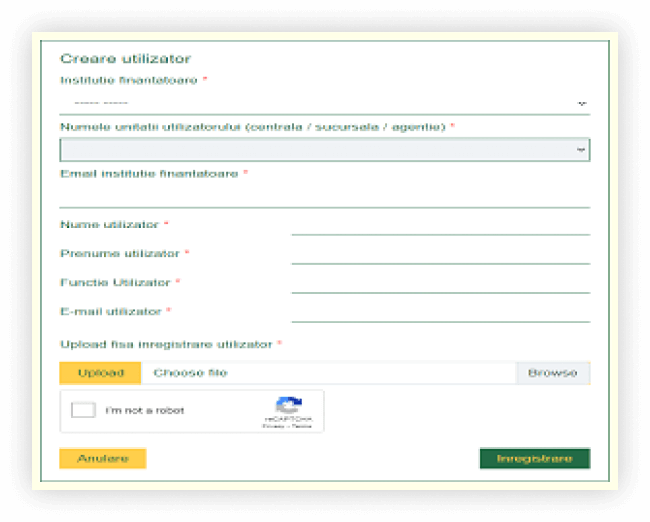

- Public user creation, based on a standardized form, secured by Google reCAPTCHA;

- User Roles & Login - Microsoft ASP.Net Identity;

- Encrypted passwords - BCrypt.Net-Next;

- Logging messages - Serilog;

- Scan malicious content files - nClam;

- Detection of the uploaded file type by reading the header area - FileSignatures;

- Generation of forms / annexes / contracts, with user data - Mono.TextTemplating;

- Generating documents in PDF format - ABC Pdf;

- Generating reports in Excel format

- u pre-2007: NPOI;

- u post-2007: EPPlus.

- Access the database - Dapper ORM;

- WEB interface - Twitter Bootstrap;

- WEB notifications - Toastr.js.

Features & functionalities

- Profiles registration and creation (for financial institutions);

- Collecting data from financial institutions and banks;

- Registration of warranty claims;

- Registration of changes for existing requests;

- Listing, filtering, exporting recorded data for each client;

- Financial data analysis and validation;

- Request for modification of invalid data;

- Data standardization and synchronization (with the data stored by the existing app);

- Generating and downloading contracts for signing and re-loading them to conclude financing;

- Customize the upload settings that must be fulfilled by a file;

- View request history: validation statuses, modified values;

- Re / Assigning the request to a manager.

Project stages

1

Auditing the client's needs and expectations

2

Project consulting services

3

Delivery and validation of the project proposal

4

Implementation and testing of the solution

5

Delivery of documentation for the efficient use of the platform

WHY ROWEB?

In 2004 we started with a small web dev team wanting to make a difference in the software services market.

Today we count about 127 professionals that are part of our team and over 1000 successfully delivered projects for global clients (from 30 countries).

Usually, our clients recommend our services because we know how to:

- think outside the box;

- deliver smart and customized solutions;

- allocate dedicated teams;

- embody innovative technologies;

- customize and adapt to new and changing requests;

- offer an excellent cost/quality ratio;

- deliver perfect integration between the solutions.