HOW YOU CAN USE DATA ANALYTICS IN

Finance & Banking

Risk Assessment:

Traditional credit scoring models have limitations when it comes to evaluating solvency. Machine learning systems can analyze complex and diverse data sources – such as transaction history, social media activity, etc. – to provide more accurate assessments of credit risk. Models like gradient boosting, neural networks, or ensemble methods can significantly improve decision-making in credit approval processes.

Fraud Detection:

Financial institutions constantly face the risk of fraudulent activities. Machine learning–based models are powerful tools for anomaly detection, enabling the identification of potential fraudulent behavior. Techniques such as anomaly detection, supervised learning, and network analysis can strengthen and enhance existing fraud detection systems.

Algorithmic Trading and Investment Strategies:

Machine learning algorithms can analyze market trends, historical data, and other influencing factors to develop more advanced trading strategies. Reinforcement learning, neural networks, and natural language processing (NLP) are among the techniques used to make informed trading decisions and optimize investment portfolios.

Customer Service and Personalization:

Machine learning allows banks and financial institutions to deliver highly personalized customer experiences. NLP-powered chatbots can handle client inquiries, while recommendation engines leverage behavioral data to suggest tailored financial products and services.

HOW YOU CAN USE DATA ANALYTICS IN

Insurance

Risk Assessment:

Machine learning algorithms can analyze diverse data sources – including customer information, historical claims data, telematics, and external data – to better evaluate risks. This helps insurers design more accurate pricing policies and make well-informed decisions.

Fraud Detection:

Insurance fraud is a major challenge that affects the industry. Machine learning models assist in detecting anomalies in claims data, identifying suspicious patterns, and flagging potential fraud cases. Techniques such as anomaly detection, predictive modeling, and network analysis play a key role in fraud prevention.

Claims Processing and Automation:

Machine learning can streamline the claims process by automating tasks such as document processing, damage assessment, and claims verification. Optical Character Recognition (OCR) combined with ML algorithms can extract key information from documents, accelerating claims resolution.

Predictive Analytics for Risk Mitigation:

Machine learning models can predict and reduce risks by analyzing data patterns related to policyholders, market trends, and other variables. Predictive analytics enables insurers to proactively manage risks, prevent losses, and improve overall portfolio performance.

HOW YOU CAN USE DATA ANALYTICS IN

Telecommunications

Network Optimization and Management:

Predictive Maintenance for Infrastructure:

Machine learning algorithms can process data from sensors and devices within telecom infrastructure to predict potential failures or maintenance needs. Predictive maintenance minimizes downtime, improves service availability, and reduces maintenance costs.

Churn Prediction and Customer Retention:

Machine learning models can analyze customer data, usage patterns, and behaviors to predict potential service cancellations. By identifying the factors that contribute to churn, telecom companies can implement targeted retention strategies and personalized offers to reduce customer loss.

Fraud Detection and Security:

Telecom providers face various fraud risks, including subscription fraud and call record manipulation. Machine learning models can detect anomalies in usage patterns, network traffic, and subscriber behavior to identify potential fraud, enhancing security measures.

Service Quality and Customer Experience:

Machine learning helps monitor and improve service quality by analyzing network performance metrics, call data records, and customer feedback. This enables telecom providers to identify and resolve issues proactively, resulting in improved customer experiences.

HOW YOU CAN USE DATA ANALYTICS IN

Real Estate

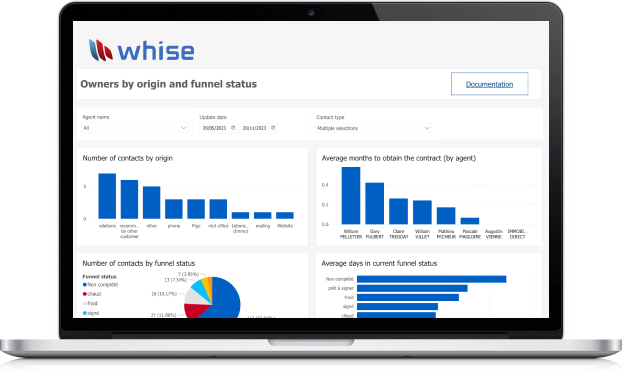

Property Valuation:

Estimating property prices is a significant challenge. Machine learning models – especially regression algorithms – can analyze historical sales data, location attributes, market trends, and property features to provide more accurate property value estimates.

Demand Prediction:

Understanding future demand for specific property types in certain locations is crucial for developers and investors. Machine learning models can analyze demographic data, economic indicators, and historical sales to forecast demand across different sectors, supporting strategic decision-making.

Property Recommendations:

Matching properties with potential buyers or tenants can be difficult due to varying preferences. Machine learning–based recommendation systems, using collaborative filtering or content-based approaches, can suggest properties to users based on their past interactions, preferences, and behaviors.

Risk Assessment and Fraud Detection:

Machine learning can help evaluate risks associated with real estate investments and loans. Models can analyze financial data, market trends, and historical patterns to identify potential risks and anomalies, assisting in fraud detection and risk mitigation.

Portfolio Management and Investment Strategy:

Real estate investors often face challenges in optimizing portfolios and designing effective investment strategies. Machine learning algorithms can analyze market trends, historical performance data, and risk profiles to provide insights for portfolio optimization and better decision-making.

HOW YOU CAN USE DATA ANALYTICS IN

Tourism & Hospitality

Personalized Recommendations and Customer Experience:

Machine learning algorithms can analyze customer preferences, behaviors, and historical data to deliver personalized recommendations for travel destinations, accommodations, and more. Recommendation systems based on collaborative filtering and content-based approaches can enhance customer satisfaction.

Demand Forecasting and Price Optimization:

Estimating demand for specific destinations, accommodations, or services is essential for pricing strategies and resource allocation. Machine learning models can analyze historical booking data, seasonality, events, and external factors to accurately forecast demand, enabling companies to optimize pricing and availability.

Reputation Management:

Monitoring and understanding customer perceptions and reviews across multiple platforms is vital for reputation management in the hospitality industry. Natural Language Processing (NLP) models can analyze reviews, social media content, and feedback to assess customer satisfaction levels and identify areas for improvement.

Operational Efficiency and Resource Management:

Machine learning can optimize various operational aspects of hospitality, such as staff scheduling, inventory management, energy consumption, and maintenance programs. Predictive analytics and optimization algorithms help streamline operations, reduce costs, and increase efficiency.

Destination Management and Planning:

Machine learning can support the analysis of tourist behavior, traffic patterns, and preferences to improve destination management and planning. Predictive models can forecast visitor arrivals, identify peak times, and optimize tourist flows, contributing to better infrastructure planning and resource allocation.

HOW YOU CAN USE DATA ANALYTICS IN

eCommerce

Personalized Shopping Experience:

Machine learning algorithms can analyze customer behavior, browsing history, purchase patterns, and demographic data to deliver personalized product recommendations. Recommendation systems using collaborative filtering or content-based approaches can suggest relevant products, increasing customer engagement and sales.

Inventory Management and Demand Forecasting:

Accurately predicting product demand and managing stock efficiently are critical for eCommerce businesses. Machine learning models can analyze historical sales data, seasonality, trends, and external factors to forecast demand with precision. This helps optimize stock levels while reducing the risk of stockouts or overstocking.

Fraud Detection and Prevention:

ECommerce platforms are highly exposed to fraudulent activities. Machine learning models can detect anomalies in transaction patterns, user behavior, and payment information to flag potential fraud. Techniques such as anomaly detection, supervised learning, and network analysis enhance fraud prevention efforts.

Dynamic Pricing and Revenue Optimization:

Machine learning algorithms can optimize pricing strategies by analyzing competitor prices, market demand, customer behavior, and other variables in real time. Dynamic pricing models can adjust prices automatically to maximize revenue while remaining competitive.